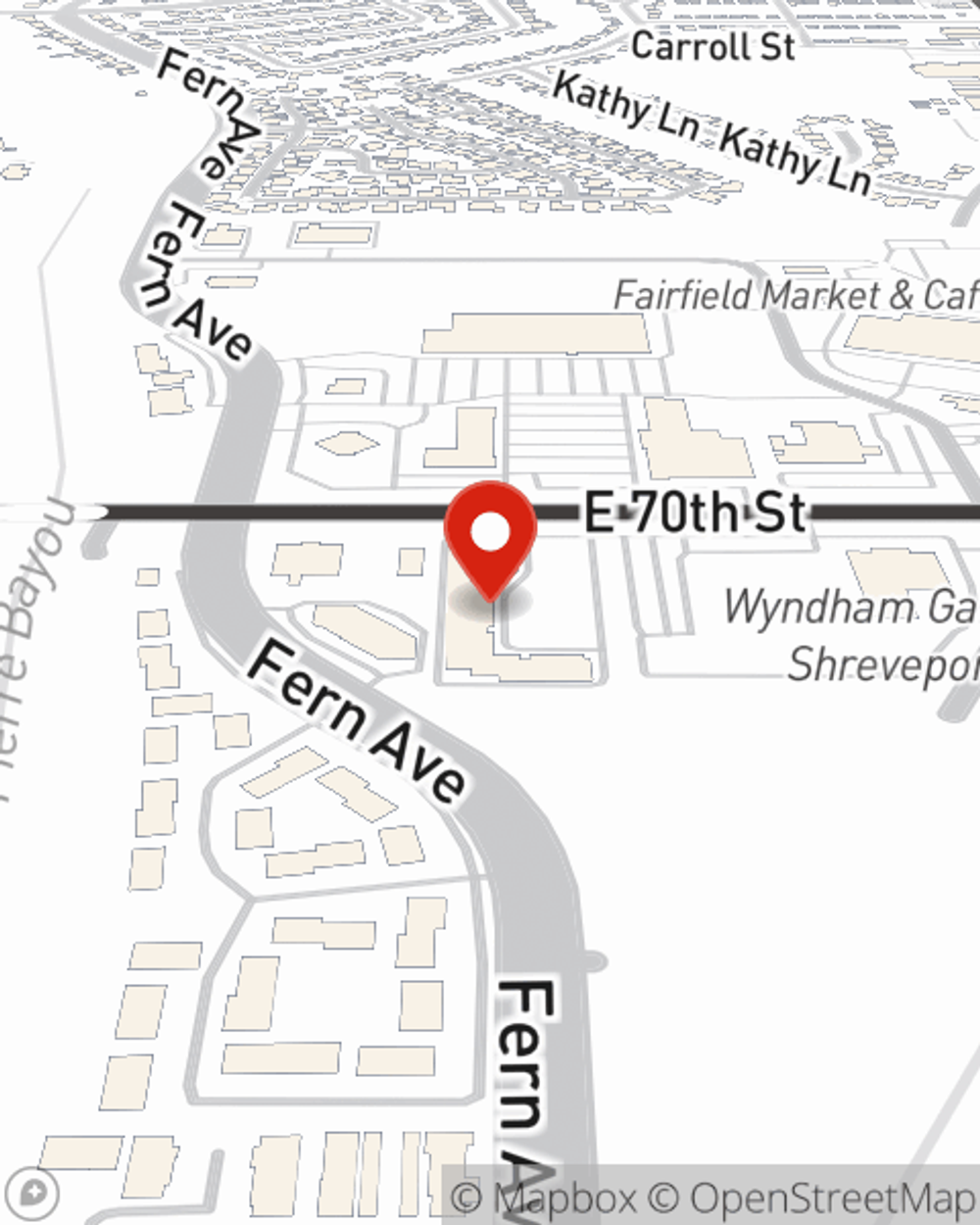

Business Insurance in and around Shreveport

No funny business here

Business Insurance At A Great Value!

Running a small business is hard work. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, trades, contractors and more!

No funny business here

Cover Your Business Assets

Your business thrives off your determination, creativity, and having outstanding coverage with State Farm. While you make decisions for the future of your business and support your customers, let State Farm do their part in supporting you with business owners policies, commercial liability umbrella policies, and artisan and service contractors policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Wesley Eckles is here to help you learn about your options. Reach out today!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Wesley Eckles

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".